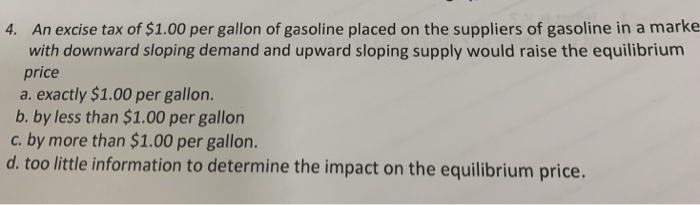

A tax of $1.00 per gallon on gasoline is a policy measure that has been proposed to address concerns about environmental degradation and transportation funding. This tax would have significant economic and environmental implications, which warrant careful consideration.

The potential effects of a gasoline tax on consumer spending, business costs, inflation, and economic growth are complex and multifaceted. Distributional effects, or the impact on different income groups, are also an important consideration.

Economic Impact

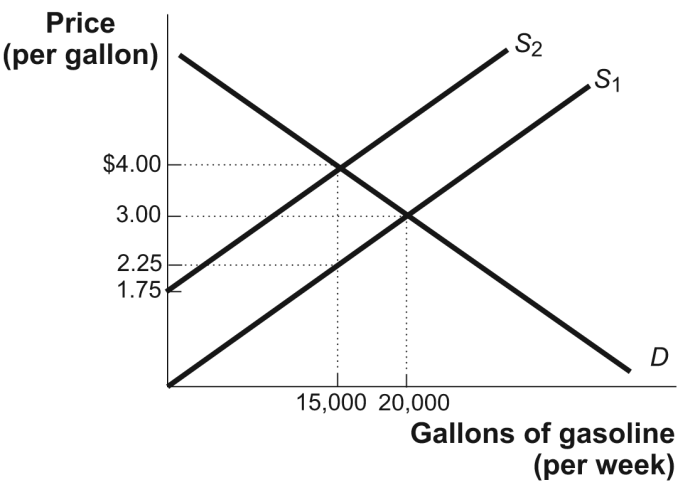

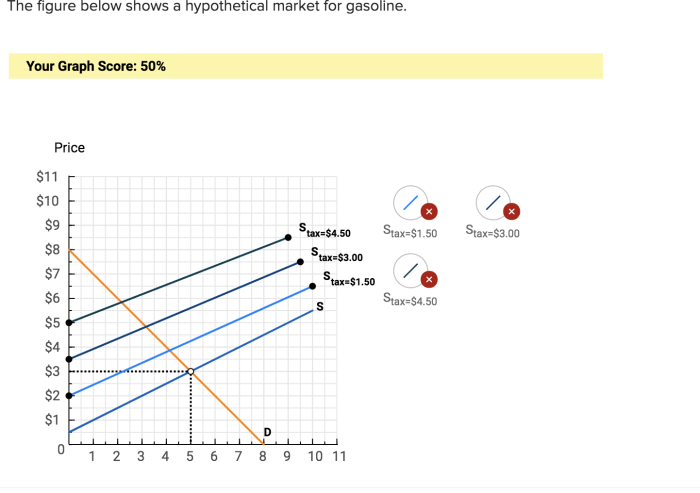

The imposition of a $1.00 per gallon tax on gasoline is expected to have significant economic consequences. The immediate effect would be an increase in the price of gasoline, which would directly impact consumer spending and business costs.

Higher gasoline prices would reduce disposable income for consumers, leading to a decline in spending on other goods and services. This could have a ripple effect on the economy, as businesses that rely on consumer spending may experience a decrease in demand and revenue.

Impact on Inflation

The tax would also contribute to inflationary pressures. As businesses pass on the increased costs to consumers, the prices of other goods and services would rise. This could lead to a sustained increase in the overall price level, eroding the purchasing power of consumers and businesses.

Impact on Economic Growth

The negative impact on consumer spending and business costs could also have implications for economic growth. Reduced consumer demand and business investment could lead to a slowdown in economic activity, potentially resulting in job losses and a decline in overall output.

Distributional Effects

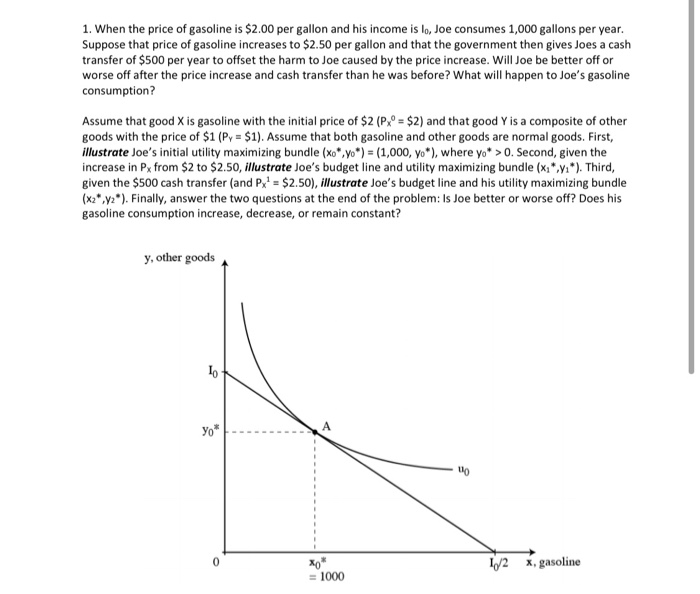

The tax would have a disproportionate impact on low-income households, who spend a larger share of their income on gasoline. This could exacerbate existing income inequalities and create additional financial burdens for those who can least afford it.

Environmental Considerations

Imposing a $1.00 per gallon tax on gasoline has significant environmental implications. This tax would likely reduce fuel consumption, leading to a decrease in greenhouse gas emissions and air pollution. However, it could also have unintended consequences, such as increased driving of less fuel-efficient vehicles.

Impact on Fuel Consumption and Greenhouse Gas Emissions

The primary environmental benefit of a gasoline tax is the reduction in fuel consumption. As the price of gasoline increases, consumers are likely to drive less and use more fuel-efficient vehicles. This would lead to a decrease in greenhouse gas emissions, which contribute to climate change.

According to the U.S. Environmental Protection Agency, transportation is the largest source of greenhouse gas emissions in the United States. In 2020, transportation accounted for 27% of total greenhouse gas emissions, with light-duty vehicles (cars and light trucks) contributing the most.

A gasoline tax would help to reduce these emissions by discouraging driving and promoting the use of more fuel-efficient vehicles.

Effects on Air Quality and Public Health

In addition to reducing greenhouse gas emissions, a gasoline tax would also improve air quality. Gasoline combustion releases harmful pollutants into the air, including particulate matter, nitrogen oxides, and carbon monoxide. These pollutants can cause respiratory problems, heart disease, and cancer.

A gasoline tax would reduce air pollution by discouraging driving and promoting the use of more fuel-efficient vehicles. This would lead to lower levels of harmful pollutants in the air, which would improve public health.

Potential Unintended Consequences

While a gasoline tax has many potential environmental benefits, it could also have some unintended consequences. One concern is that it could lead to increased driving of less fuel-efficient vehicles. This could happen if consumers switch to older, less fuel-efficient vehicles in order to save money on gas.

It could also happen if consumers drive more miles in their existing vehicles, even if they are less fuel-efficient.

Another concern is that a gasoline tax could disproportionately impact low-income households. Low-income households are more likely to drive older, less fuel-efficient vehicles and to live in areas with limited access to public transportation. A gasoline tax would increase the cost of transportation for these households, which could make it difficult for them to get to work, school, and other essential activities.

Revenue Generation and Allocation

The proposed tax of $1.00 per gallon on gasoline has the potential to generate significant revenue for the government. Estimates vary, but it is projected that the tax could raise anywhere from $20 billion to $50 billion per year. This revenue could be allocated in various ways, including funding transportation infrastructure, environmental programs, or other government priorities.

One potential use of the revenue is to invest in transportation infrastructure. This could include funding road and bridge repairs, expanding public transportation systems, or developing new technologies to improve transportation efficiency. Investing in transportation infrastructure would have a number of benefits, including reducing traffic congestion, improving air quality, and creating jobs.

Another potential use of the revenue is to fund environmental programs. This could include funding research into renewable energy sources, providing incentives for businesses to reduce their carbon emissions, or investing in programs to protect natural resources. Funding environmental programs would help to address the challenges of climate change and protect the environment for future generations.

Potential for Corruption or Misuse of Funds

It is important to note that there is always the potential for corruption or misuse of funds when large amounts of money are involved. To mitigate this risk, it is important to establish clear rules and procedures for how the revenue will be allocated and used.

It is also important to have strong oversight mechanisms in place to ensure that the funds are being used appropriately.

Political and Social Implications

The political feasibility of implementing a $1.00 per gallon tax on gasoline hinges on several key factors, including the level of public support, the potential for industry backlash, and the overall economic climate. While some may argue that such a tax would be politically unpopular, recent surveys indicate that a majority of Americans support measures to address climate change, including carbon pricing mechanisms like gasoline taxes.

However, the transportation industry, which is heavily reliant on gasoline, is likely to oppose such a tax, citing concerns about increased operating costs and potential job losses. It is essential to engage with industry stakeholders and address their concerns through targeted incentives or transition assistance programs to mitigate the negative impacts and foster collaboration.

Public Backlash and Support, A tax of

.00 per gallon on gasoline

Public backlash to a gasoline tax is a legitimate concern, particularly in regions heavily dependent on personal vehicles. To address this, policymakers must effectively communicate the rationale behind the tax, emphasizing its environmental and revenue-generating benefits. Public education campaigns can help raise awareness about the urgency of climate change and the need for transitioning to cleaner energy sources.

Furthermore, policymakers can consider implementing the tax gradually over time to minimize the immediate impact on consumers and businesses. This approach allows individuals and industries to adjust their behavior and reduce their reliance on gasoline.

Impact on Transportation Industry and Other Affected Sectors

The transportation industry, particularly the trucking and logistics sectors, would be significantly impacted by a gasoline tax. Increased fuel costs would lead to higher transportation expenses, which could be passed on to consumers in the form of higher prices for goods and services.

To mitigate these impacts, policymakers can explore providing targeted incentives or subsidies to the transportation industry to support the transition to more fuel-efficient vehicles and alternative fuels. Additionally, investing in public transportation infrastructure can provide consumers with affordable and environmentally friendly transportation options, reducing their reliance on personal vehicles.

International Comparisons

Several countries have implemented similar taxes on gasoline, providing valuable insights into their effectiveness and potential implications.

One notable example is the United Kingdom, which introduced a fuel duty in 1993. This tax has been gradually increased over time and currently stands at approximately $0.75 per gallon. The tax has been credited with reducing fuel consumption and generating significant revenue for the government.

Lessons Learned

- Taxes on gasoline can effectively reduce fuel consumption, leading to environmental benefits and energy conservation.

- The revenue generated from these taxes can be substantial, providing governments with additional funds for infrastructure, public services, or deficit reduction.

- It is important to strike a balance between the environmental and economic impacts of such taxes to avoid unintended consequences.

International Trade and Competitiveness

Taxes on gasoline can have implications for international trade and competitiveness. Higher fuel costs can increase transportation costs for businesses, potentially affecting the prices of goods and services. However, these taxes can also incentivize the development of more fuel-efficient technologies and alternative energy sources, which can benefit the economy in the long run.

Alternatives to a Gasoline Tax

Several policy measures can be considered as alternatives to a gasoline tax to address the issues associated with gasoline consumption. These alternatives vary in their effectiveness, costs, and benefits, and each has its own set of pros and cons.

Cap-and-Trade Programs

Cap-and-trade programs set a cap on the total amount of greenhouse gas emissions that can be emitted by a particular industry or sector. Companies are then issued permits that allow them to emit a certain amount of emissions. If a company exceeds its permit, it must purchase additional permits from other companies that have emitted less than their allowance.

- Pros:Cap-and-trade programs can be effective in reducing emissions and provide flexibility for companies to find the most cost-effective way to reduce their emissions.

- Cons:Cap-and-trade programs can be complex and difficult to administer, and they may not be effective in reducing emissions if the cap is set too high.

Vehicle Emissions Standards

Vehicle emissions standards set limits on the amount of pollutants that can be emitted by new vehicles. These standards have been effective in reducing emissions from new vehicles, but they do not address emissions from older vehicles.

- Pros:Vehicle emissions standards are relatively easy to implement and enforce, and they can be effective in reducing emissions from new vehicles.

- Cons:Vehicle emissions standards do not address emissions from older vehicles, and they can increase the cost of new vehicles.

Public Transportation and Land Use Planning

Public transportation and land use planning can help to reduce gasoline consumption by making it easier for people to get around without driving. Public transportation can provide a convenient and affordable alternative to driving, and land use planning can create communities that are more walkable and bikeable.

- Pros:Public transportation and land use planning can be effective in reducing gasoline consumption and improving air quality.

- Cons:Public transportation and land use planning can be expensive to implement, and they may not be feasible in all communities.

Comparison of Alternatives to a Gasoline Tax

The table below compares the pros and cons of a gasoline tax to the pros and cons of the alternative policy measures discussed above.

| Policy Measure | Pros | Cons |

|---|---|---|

| Gasoline Tax | Easy to implement and enforce; generates revenue that can be used to fund transportation projects or other programs; can be effective in reducing gasoline consumption. | Can be regressive; may not be effective in reducing emissions if the tax is set too low. |

| Cap-and-Trade Programs | Can be effective in reducing emissions; provides flexibility for companies to find the most cost-effective way to reduce their emissions. | Complex and difficult to administer; may not be effective in reducing emissions if the cap is set too high. |

| Vehicle Emissions Standards | Relatively easy to implement and enforce; can be effective in reducing emissions from new vehicles. | Do not address emissions from older vehicles; can increase the cost of new vehicles. |

| Public Transportation and Land Use Planning | Can be effective in reducing gasoline consumption and improving air quality. | Expensive to implement; may not be feasible in all communities. |

Top FAQs: A Tax Of

.00 Per Gallon On Gasoline

What is the purpose of a gasoline tax?

A gasoline tax is primarily intended to raise revenue for transportation infrastructure and environmental programs.

How would a gasoline tax affect the economy?

The economic impact of a gasoline tax is complex and depends on various factors, including the size of the tax, consumer spending patterns, and the response of businesses. It could lead to increased consumer spending on other goods and services, reduced business profits, and potentially higher inflation.

What are the environmental benefits of a gasoline tax?

A gasoline tax can encourage fuel conservation and reduce greenhouse gas emissions by making driving more expensive. It can also improve air quality by reducing vehicle emissions.